Inside her late grandfather’s mattress, Brooke uncovers a stash that shatters everything she thought she knew about her parents’ death. But this hidden secret doesn’t just affect her; it threatens to destroy the entire town.

Brooke stood in the doorway of her grandfather’s bedroom, her nose prickling as memories flooded her mind. Her breath came in unevenly as she remembered all the times she had visited him, almost hearing Granddad Charles’s hearty laugh echoing through the halls.

“I can’t believe he’s truly gone,” she whispered, running her hand along the old oak dresser.

For illustration purposes only | Source: Midjourney

The room smelled of old books and the faint scent of Granddad’s favorite pipe tobacco and his signature Aqua Velva aftershave.

After a moment, Brooke’s eyes fell on a framed photo of her parents on the nightstand. She was truly alone in this world now, as they had died years ago in a freak car accident.

As she began the daunting task of sorting through Granddad’s belongings, her mind wandered to how Granddad had never allowed anyone to touch his bed.

“Don’t you ever touch that mattress, young lady,” Granddad would say whenever Brooke jumped and bounced on the surface as a child. “It’s got more secrets than you can imagine.”

Now, standing before that very bed, Brooke felt an irresistible pull. She lifted one corner of the mattress, figuring that any secret would be hidden beneath.

She didn’t actually expect to find anything, much less something that would change everything. Beneath the mattress lay a small leather-bound book, yellowed newspaper clippings, and a stack of photographs.

For illustration purposes only | Source: Unsplash

“Oh, Granddad,” Brooke breathed, “what were you hiding?”

She took the items and sifted through the papers. As she read, her eyebrows raised in surprise. For some reason, Granddad had meticulously documented the investigation into her parents’ “accident.”

He had been obsessed with it, claiming the police officers were corrupt, despite having served as a cop for decades himself. He had insisted that something was wrong.

Brooke hadn’t believed him then, but now, with the evidence before her, she felt compelled to dig deeper. Investigating this matter suddenly became her entire focus.

For illustration purposes only | Source: Unsplash

“Mr. Johnson was seen leaving the Starlight Lounge, visibly intoxicated,” she read aloud. “Officer Parker waved him through a checkpoint.”

Brooke’s hands trembled as she pieced together the truth that her granddad had uncovered: the police had covered up the drunk driving of a wealthy person in town who run into her parents.

Hot, angry tears streamed down her face, but she refused to break down from the unfairness and frustration. She knew she had to do something about this information.

For illustration purposes only | Source: Midjourney

“I’ll finish what you started, Granddad,” Brooke vowed. “They won’t get away with this.”

***

The next day, Brooke marched into the offices of the local newspaper, her granddad’s evidence tucked safely in her bag.

The bustling newsroom barely noticed her arrival, but she didn’t care.

Brooke walked straight to an editor’s office and blurted out, “I’ve got a story you need to hear!”

For illustration purposes only | Source: Unsplash

The gruff man sitting behind the desk looked up from his reading and leaned back in his chair, eyeing Brooke warily. “Hello, young lady. I’m Frank, and I have to tell you, we get a lot of people in here claiming to have the next big scoop. What makes yours special?”

Brooke took a deep breath, sat in the chair opposite the editor, and began to lay out the facts. As she spoke, Frank’s expression changed from doubt to intrigue.

After a few minutes, he leaned forward, resting his head on his linked hands, clearly captivated by the story unfolding before him.

For illustration purposes only | Source: Pixabay

“This is explosive stuff, Ms. Taylor,” he said when she finished. “Are you sure you want to go public with this? There could be serious consequences.”

Brooke’s eyes flashed with determination. “Sir, I’ve spent years wondering why the universe took my parents. Every birthday, every holiday, every milestone in my life since they died has been overshadowed by this unanswered question. Now that I know it wasn’t just fate, but foul play, I can’t sit on it. This isn’t just about my family anymore. It’s about every person in this town who’s been told to accept injustice because that’s just how things are.”

For illustration purposes only | Source: Midjourney

Frank studied her for a moment, then nodded slowly. “Alright, Ms. Taylor. We’ll run the story. But I need you to understand something. This isn’t going to be easy. People are going to come after you, try to discredit you, and maybe even threaten you. Are you prepared for that?”

“My grandfather was a cop for thirty years,” Brooke responded. “He taught me that doing the right thing isn’t always easy, but it’s always necessary. I’m ready for whatever comes.”

Frank’s face softened slightly. “Your grandfather sounds like he was a good man. Alright, let’s get to work. We’ve got a lot to do if we’re going to break this story wide open.”

For illustration purposes only | Source: Unsplash

***

The story hit the front page the following week, and Brooke’s phone buzzed constantly with messages of support and outrage.

She also took to social media, sharing the link to the story and rallying people to demand justice.

“My parents deserved better,” she wrote in a viral post. “We all deserve better from those sworn to protect us.”

As public pressure mounted, the police department grudgingly reopened the case.

For illustration purposes only | Source: Unsplash

Brooke watched with grim satisfaction as Officer Parker, the officer in charge of the original investigation, squirmed under questioning during a special press conference.

“We had no choice,” he finally admitted. “Mr. Johnson’s family has connections. We were told to make it go away.”

The Johnson family was indeed wealthy and influential, owning many businesses in the area and having funded the campaigns of several local government officials.

For illustration purposes only | Source: Unsplash

The revelation sent shockwaves through the community, leading to protests outside the police station as citizens demanded accountability and transparency.

Protesters also gathered at Mr. Johnson’s and his family’s known properties in town. The Johnson family quickly lawyered up and hired PR representatives to try to discredit Brooke.

However, in this political climate, people were more inclined to believe the young woman who had lost everything. The community’s support for Brooke only grew stronger, and the pressure on the Johnson family and local officials intensified.

For illustration purposes only | Source: Midjourney

While walking down the street one day, Brooke was suddenly surrounded by a swarm of reporters.

“Ms. Taylor, some people are saying you’re doing this for attention or financial gain. How do you respond to that?” one journalist asked.

Brooke’s eyes flashed with emotion, but she took a deep breath before responding. “I lost my parents when I was eight years old. Do you know what that’s like? I’m not doing this for fame or money. I’m doing it because for years, I’ve had a hole in my heart where my parents should be, and my granddad believed something was wrong. How could I possibly stay silent?”

For illustration purposes only | Source: Pexels

Her voice broke slightly, but she continued

“This isn’t just about me. It’s about every family who’s lost someone because people in power decided their lives were less important than protecting the wealthy and influential. It’s about making sure no other child has to grow up feeling like their parents’ lives didn’t matter. So no, I don’t care about attention or money. I care about justice, pure and simple.”

As the investigation progressed, more details emerged. It turned out that Mr. Johnson had a history of drunk driving incidents that had been swept under the rug, further fueling the community’s outrage and deepening the scandal.

For illustration purposes only | Source: Unsplash

Other families came forward with similar stories of injustice, further exposing the depth of corruption in the town.

Months later, a trial was set, becoming a media circus. Each day, the courthouse steps were crowded with reporters and protesters.

Inside a cold courtroom, Brooke sat stoically as Mr. Johnson finally faced justice.

The prosecution presented a damning case, bolstered by the evidence her granddad had gathered. Brooke testified about the emotional and financial strains her small family suffered after her parents’ death, vividly describing the pain and loss they endured.

For illustration purposes only | Source: Midjourney

But Brooke also added her own emotions, and the judge allowed her to speak. “My grandfather never stopped searching for the truth,” she said. “He knew something wasn’t right, and he refused to let it go. I’m here to finish what he started.”

As the trial neared its end, the Johnson family contacted the D.A.’s office, hoping for a settlement. The prosecutors consulted Brooke, but she refused any monetary offer.

“Money was always how the Johnsons solved things,” she thought. “Not anymore!”

For illustration purposes only | Source: Unsplash

The case continued, and on the last day, Mr. Johnson stood and looked at Brooke. “I’m sorry,” he said quietly. “I know it doesn’t change anything, but I truly am sorry.”

Brooke simply nodded.

The case concluded, and the jury took a couple of days to deliberate. The courtroom was hushed as they filed in.

“How do you find the defendant?” the judge asked.

For illustration purposes only | Source: Midjourney

“Guilty, Your Honor,” the jury foreman replied.

A collective gasp rippled through the room. Brooke closed her eyes and felt a wave of relief wash over her. We did it, Granddad!

The aftermath of the trial brought sweeping changes to the town. Several corrupt officers were fired, and new policies were implemented to ensure greater accountability.

For illustration purposes only | Source: Pexels

The case and her story were the talk of the town for a long time, but Brooke didn’t care about the attention. Justice had been served, and Mr. Johnson would spend several years in jail.

Now, it was time to look to the future, and perhaps… help others find justice too.

For illustration purposes only | Source: Midjourney

This work is inspired by real events and people, but it has been fictionalized for creative purposes. Names, characters, and details have been changed to protect privacy and enhance the narrative. Any resemblance to actual persons, living or dead, or actual events is purely coincidental and not intended by the author.

The author and publisher make no claims to the accuracy of events or the portrayal of characters and are not liable for any misinterpretation. This story is provided “as is,” and any opinions expressed are those of the characters and do not reflect the views of the author or publisher.

My Son Brought Home a Stranger After School, Saying She Was His ‘Real Mom’

When Ethan burst through the door, dragging a stranger in tow and calling her his “real mom,” I thought I had stepped into some alternate reality. The woman’s tear-streaked face and trembling hands only deepened the mystery. Who was she, and why was she claiming my son?

Have you ever experienced something that made you question if everything was real? Something that made you think maybe you were dreaming?

That’s exactly how I felt when my son said some stranger was his “real mom.” I blinked a few times, half-hoping I’d snap out of it and find myself back in my normal, predictable life.

A woman standing in her house | Source: Midjourney

Before I dive into what happened, let me tell you a bit about myself.

My name’s Maureen, and I’ve always considered my life to be pretty ordinary. I met my husband, Arnold, while working at the local grocery store. He came in looking for some obscure ingredient, anchovy paste, I think, and seemed completely lost.

“Excuse me,” he said, holding up his shopping list like a white flag. “Do you happen to know where I can find this?”

A man standing in a store | Source: Midjourney

“You’re in luck,” I replied, pointing him toward aisle six. “But fair warning… It’s not exactly a crowd favorite.”

We chatted for a bit as I rang up his items, and before I knew it, he was coming back to the store every week, always finding an excuse to strike up a conversation.

“You must really like anchovies,” I teased him once.

“Not really,” he admitted with a sheepish grin. “But I do like talking to you.”

A man talking to a woman | Source: Midjourney

It wasn’t long before he asked me out.

Arnold was sweet and kind, and he had this way of making me feel like the most important person in the room.

Within a few months, we were inseparable.

When he proposed, it wasn’t some grand gesture with fireworks or a flash mob. Just a quiet moment at my parents’ house over dinner.

A ring | Source: Pexels

“I don’t want to spend another day without you,” he said, slipping a simple gold band onto my finger.

I said yes without hesitation.

After we got married, I kept working at the grocery store for a while. Arnold had a stable job at an accounting firm, and though money was tight, we managed.

However, things changed when I found out I was pregnant with Ethan.

The moment I held him in my arms, my priorities shifted.

A baby’s feet | Source: Pexels

I decided to stay home and raise him, pouring all my love and energy into being the best mom I could be.

Arnold supported my decision, and together, we built a happy life.

That’s why it felt like any other day when I heard the doorbell ring as I was making lunch. It was around the time Ethan usually got home from school, so I assumed it was him.

A woman working in the kitchen | Source: Pexels

The water on the stove was boiling over, so I hurried to turn down the heat, barely paying attention as I called out, “Come in, sweetheart! I’ll be there in a second!”

“Mom!” Ethan’s voice echoed from the front door. “I brought someone home to meet you!”

I grabbed a dish towel and wiped my hands.

“Okay, sweetie, but let me know who it is next time!” I said, distracted by the bubbling sauce on the stove.

It wasn’t until I glanced toward the front door that I realized something was off.

A doorknob | Source: Pexels

Standing beside Ethan wasn’t one of his friends or a neighbor.

It was a woman in her mid-40s. Her pale face and red-rimmed eyes told me she’d been crying. She clutched a small bag to her chest and looked like she was about to fall apart.

“Uh, hi,” I finally spoke. “Who’s this, Ethan?”

“This is Mrs. Harper,” Ethan replied. “She’s my real mom.”

“What?” I whispered, barely able to get the word out.

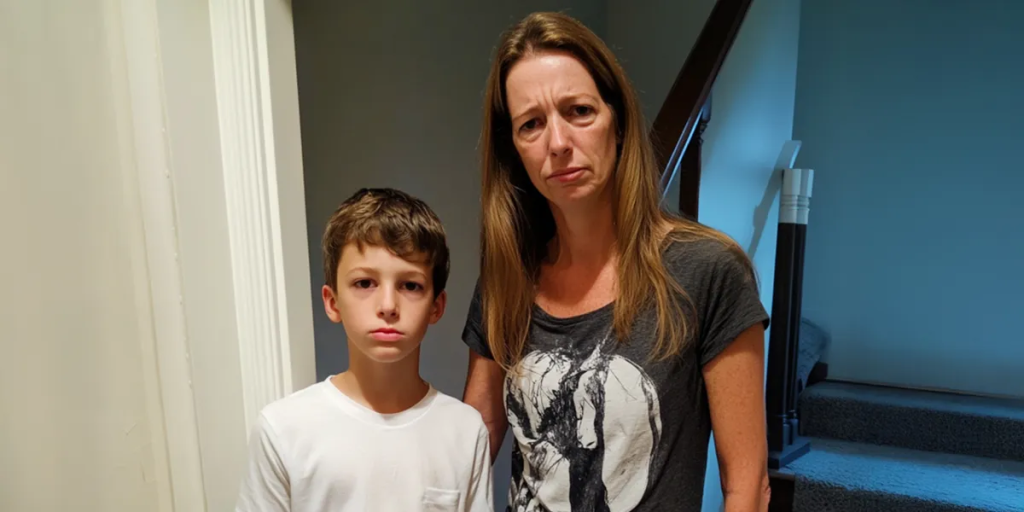

A woman standing in her house | Source: Midjourney

Mrs. Harper stepped forward, her hands visibly shaking.

“I… I’m so sorry for the confusion,” she stammered. “Ethan, sweetheart, why don’t you go wash up? We’ll talk in a minute.”

Ethan pouted, clearly not understanding the gravity of the situation. “But I wanna stay!”

“Go,” I said firmly.

Ethan looked startled but obediently trudged toward the bathroom. As soon as I heard the door close, I turned back to the woman.

“Who are you?” I demanded. “And why are you here with my son? What’s going on? Are you crazy?”

A woman looking straight ahead | Source: Midjourney

“I’m not crazy,” she began. “But there’s something you don’t know. Something neither of us knew… until now. I think Ethan is my son. My biological son.”

My brain refused to process her words.

“That’s ridiculous,” I snapped. “Ethan is my son. I gave birth to him. I’ve raised him. What are you talking about?”

“I-I’m sorry,” she said. “Please let me explain.”

I didn’t want to hear her explanation, but I couldn’t seem to stop her either.

A woman standing in a house | Source: Midjourney

“Ethan was born in MJSCR Hospital, right?” she asked.

I nodded cautiously. “Yes, but—”

“So was my son, Charlie,” she interrupted. “He would’ve been ten this year. For years, I didn’t suspect anything. But as Charlie grew older, I started noticing things. Little things that didn’t add up. He didn’t look like me or my husband. People even joked about it sometimes, saying he must take after some distant relative.”

A woman talking to another woman | Source: Midjourney

She paused, wiping at her tears.

“But I brushed it off. He was my son, and that was all that mattered. But when Charlie turned eight, he had to do a family tree project for school. He started asking questions, and I… I couldn’t give him the answers he wanted.”

She sighed.

“It got me thinking, and I decided to take a DNA test. Not because I doubted him, but because I thought it might give us more information about our ancestry.”

A back view shot of a boy | Source: Pexels

She broke down then, her words coming out in fragments.

“The results came back… and they said Charlie wasn’t mine. I didn’t know what to do. I told myself it was a mistake. I even retook the test, but the results were the same.”

“So, you think Ethan is…?” I asked, unable to complete my sentence.

A woman standing in her house | Source: Midjourney

She nodded.

“After Charlie passed away because of leukemia, I couldn’t stop thinking about the DNA test. I needed answers. So, I hired a private investigator, and he found hospital records that led me here. Our babies were accidentally exchanged at the hospital. And Ethan… he’s the right age. When I saw him today at school, I just knew.”

“This is insane,” I said, shaking my head. “Even if you think this is true, you can’t just show up and tell a ten-year-old boy that you’re his real mom.”

A woman talking to another woman in her house | Source: Midjourney

“I know,” she said. “I wasn’t thinking. When I saw him, I couldn’t stop myself. He looks so much like my husband used to when he was a boy. I’m so sorry.”

I felt like I was drowning.

My son was my entire world, and now this stranger was claiming he wasn’t mine. It didn’t make sense. It couldn’t be true.

“You’ve got this all wrong,” I said. “Ethan is my son. He’s mine.”

A woman talking | Source: Midjourney

“I understand why you’d feel that way,” she replied. “But I’m begging you… please, let’s do a DNA test. If I’m wrong, I’ll leave and never bother you again. But if I’m right…”

“I won’t let you take my son away from me even if you’re right,” I told her. “I’ll take the test. But if you’re lying, you’ll regret ever coming here.”

She nodded.

The next few days were pure agony.

Every time I looked at Ethan, I felt a knot tighten in my chest. He was my son and I couldn’t let anything change that fact.

A boy standing near a couch | Source: Midjourney

Arnold was furious when I told him what had happened.

“This is absurd,” he snapped. “Some random woman waltzes in and claims our son isn’t ours? It’s a scam, Maureen.”

“She seemed sincere,” I said, though I wasn’t entirely sure myself. “And if she’s lying, the DNA test will prove it.”

“You actually agreed to this?” Arnold looked at me with disbelief. “Do you realize what this is going to do to Ethan?”

A man talking to his wife | Source: Midjourney

He was right. This could tear our family apart. But the seed of doubt was already there, and I knew it wouldn’t go away without answers.

“I didn’t have a choice,” I whispered. “What if she’s telling the truth?”

Arnold didn’t respond. Instead, he shook his head and stormed out of the room, leaving me alone with my thoughts.

Finally, the results arrived.

My hands shook as I opened the envelope, Arnold standing stiffly by my side.

An envelope | Source: Pexels

I read the words once. Then again. But my brain struggled to process them.

Ethan wasn’t our biological child.

Arnold snatched the paper from my hands.

“This has to be wrong,” he said. “There’s no way…”

But there it was, in black and white.

The boy we had raised, loved, and called our own wasn’t ours.

We met Mrs. Harper at a park to share the results.

It felt safer there, out in the open, with Ethan nearby but far enough away that he couldn’t overhear.

A metal fence in a park | Source: Pexels

Mrs. Harper’s face crumpled the moment she saw the paper in my hand.

“I knew it,” she whispered. “I knew he was mine.”

Ethan was blissfully unaware, swinging high on the playground and laughing as the wind tousled his hair.

“What now?” I asked.

Mrs. Harper took a shaky breath.

“I don’t want to take him from you, she said. “You’ve raised him. He’s your son in every way that matters. I just need to be part of his life. Even if it’s small.”

A woman talking to another woman in a park | Source: Midjourney

Arnold clenched his fists.

“Absolutely not,” he said. “You’ve already done enough damage.”

“Arnold,” I said softly.

I could see Mrs. Harper’s pain. Her grief was etched into every line of her face. She had already lost one son, and I was sure we couldn’t deny her the chance to know the other.

After a long, difficult conversation, we agreed to let her visit occasionally.

It wasn’t an easy decision, and Arnold fought me on it for days afterward. But deep down, I knew it was the right thing to do.

A woman smiling | Source: Midjourney

In the weeks that followed, Mrs. Harper slowly became a part of our lives.

At first, it was awkward and tense, but over time, things improved. Talking to her made me realize she was just a grieving mother trying to find a way to move forward.

Ethan didn’t know the full truth, and we decided to keep it that way.

To him, Mrs. Harper was just a new friend who cared about him deeply. And maybe that was enough.

A boy smiling | Source: Midjourney

If you enjoyed reading this story, here’s another one you might like: Diana was painfully preparing herself to say goodbye to her dying husband in the hospital. While she was struggling to process that he had only a few weeks left to live, a stranger approached and whispered the jolting words: “Set up a hidden camera in his ward… you deserve to know the truth.”

This work is inspired by real events and people, but it has been fictionalized for creative purposes. Names, characters, and details have been changed to protect privacy and enhance the narrative. Any resemblance to actual persons, living or dead, or actual events is purely coincidental and not intended by the author.

The author and publisher make no claims to the accuracy of events or the portrayal of characters and are not liable for any misinterpretation. This story is provided “as is,” and any opinions expressed are those of the characters and do not reflect the views of the author or publisher.

Leave a Reply